AZSA Lunch 'N Learn | January 2026

Sponsored by U-Haul

The Big, Beautiful Bill: What Federal Tax & Economic Changes Mean for Self-Storage

Join us for an insightful event presented by Eide Bailly, where we will explore key topics such as federal legislation, depreciation, and 1031 exchanges, specifically tailored for all member types! This is your opportunity to ask questions and gain a deeper understanding of how this legislation impacts you and your business. Don’t miss out on receiving expert answers from top tax professionals!

This event is exclusively for our valued AZSA OWNER/OPERATOR members only. Vendors interested in participating should e-mail Amy Amideo.

In-Person Event - OWNER/OPERATOR, THIRD PARTY or SMALL FACILITY MEMBER RSVP

AZSA Members Ticket

| Price | |

|---|---|

|

FREE Lunch 'n Learn Event - January 2026 RSVP

This ticket is available only to "Owner/Operator", "Third Party Management", or "Small Facility" members. If you are an "Associate" member and would like to attend, please get in touch with Amy Amideo. |

FREE |

Agenda

| January 14 | |

| 11:30 AM - 12:00 PM |

CHECK IN

Guests arrive, check in, and enjoy light refreshments before the program begins. |

| 12:00 PM - 12:10 PM |

WELCOME & OPENING REMARKS

Overview of the day’s agenda, upcoming AZSA events, and introductions. Amy Amideo | Executive Director AZSA |

| 12:15 PM - 12:45 PM |

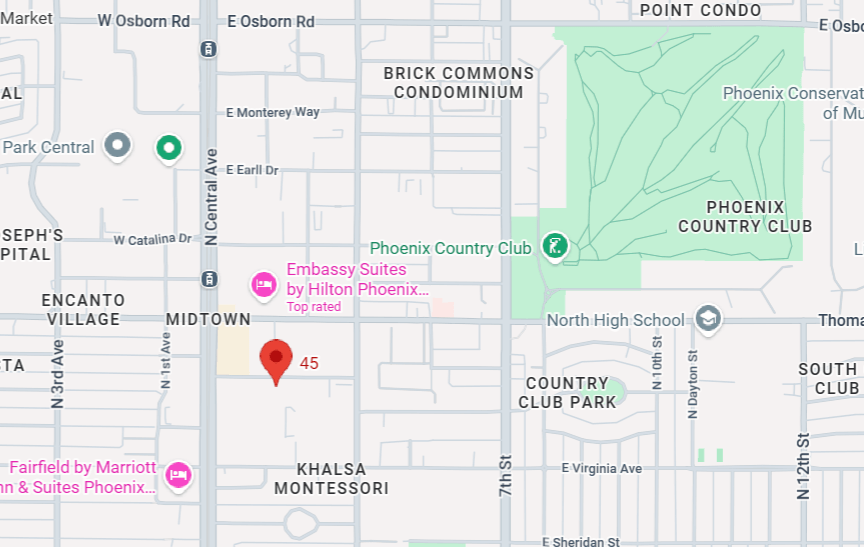

FACILITY TOUR of U-HAUL TOWERS

A behind-the-scenes look at U-Haul’s innovative facilities. Louis Coronado | Safestor Russ Baldwin | U-Haul Self Storage Affiliate Network Eric Regan | U-Haul Dealer Program |

| 12:45 PM - 2:00 PM | LUNCH SERVICE |

| 1:00 PM - 1:30 PM |

GUEST PRESENTATION

“The Big Beautiful Bill and What It Means for Storage” Presented By Matt Nunn | Eide Bailly Matt will unpack key provisions of the bill and its implications for the self-storage industry. |

| 1:30 PM - 2:00 PM |

Q&A AND DISCUSSION

Open dialogue with Matt and Attendees |

Matt Nunn is a Senior Manager in Eide Bailly’s Phoenix office, specializing in tax strategy and compliance for closely held businesses and their owners. With extensive experience advising clients in real estate and self-storage sectors, Matt helps business owners navigate complex tax legislation and optimize their financial outcomes.